Top Right Triangle

Yard Charts technical analysis software is able to discover a Top Right Triangle chart pattern

Top Right Triangle is a YardCharts bearish reversal pattern comparable to an imaginary right triangle. It is made up of two sides joined at a 90° angle and linked by a hypotenuse. In financial technical analysis we make the following associations:

- Long side: The horizontal line drawn by uniting two or more approximately equal market lows in a given temporal segment. (See line 1, in picture A);

- Short side: The imaginary vertical line with a length that is equal to the distance from the horizontal line to the market high formed above the horizontal. (See line 2, in picture A);

- Hypotenuse: The imaginary sloping line that results by linking the market highs and corresponds to the bounces formed above the horizontal. (See line 3, in picture A

The ideal model of Top Right Triangle

- There must be at least two, preferably three, bounces under the horizontal line with each corresponding to a market high. They must be in descending order starting from the left.

- While these bounces are being formulated, it is recommended that the up-velocity from the horizontal to the market highs is slower than the down-velocity from the highs back to the horizontal. This results in the up-bars from the horizontal to the market highs being more or equal in number than the down bars from the same highs back to the horizontal. Not all bounces in a Top Triangle will develop exactly as such but it helps if this characteristic materializes before the break out, as these triangles tend to perform better on average.

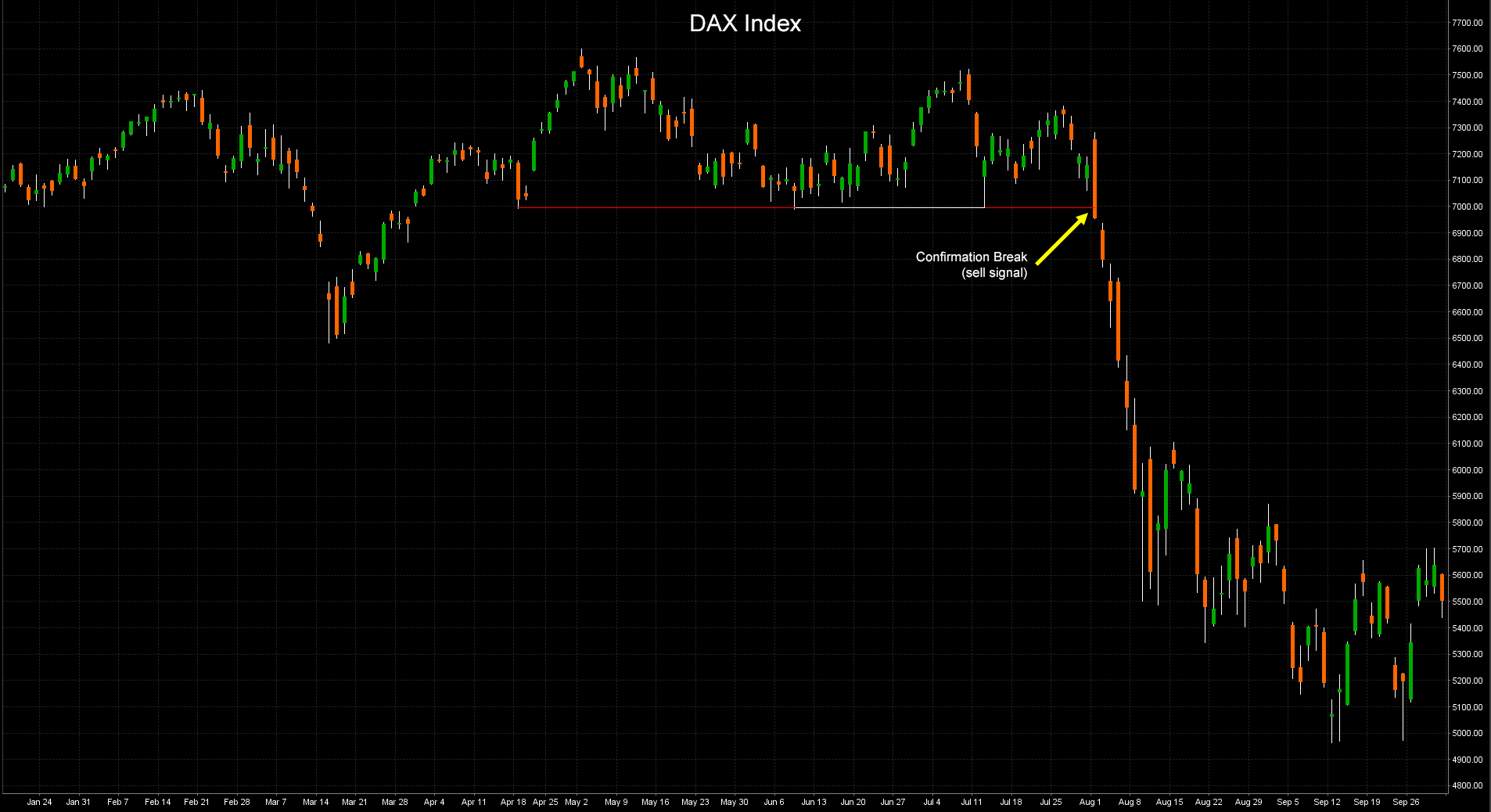

- The formation of a Top Right Triangle is confirmed when the market breaks and closes below the horizontal line after having previously formed at least two bounces. At this point, we have a sell signal, and a stop loss must be placed just above the high of the last bounce before the break out. Picture B that depicts all these properties.

Cases in point

Below are six real Top Right triangles found by YardCharts in the past (Nasdaq, Nyse), which have successfully performed from the day of the ‘sell alarm’.

Without first hitting the stop loss level the market has fallen starting from the horizontal line a distance equal at least three times the size of the stop loss (last bounce high-horizontal line).

The relevant bounces, segments, and colors are shown in each picture exactly as they appear on the alarm section (Trading Patterns) of this web site

Some Example

Read also about...

Free Yard Charts Panel

Experience Yard Charts features for free and get ready to use Yard Chart Plus. Check the stock market securities that Yard Chart suggested in the past!

It is very useful for new clients to check past alerts to better understand how the tool works and experiment with the services that YC offers. Even with a more basic functionality than YC plus, Free YC offers the investor the possibility to better understand alerts and feature.

Read moreYard Charts Plus Platform

The techincal analysis software decisive to understand the stock market trends. Through this automated charting tool, Yard Charts gives more insight and support to its clients.

Yard Charts plus is taught for private traders and institutions that are seeking an innovative technical tool to scan the stock market. A professional analitycal approach for more powerful and productive trading.

Read moreYard Charts PPV Platform

Thanks to this analytic tool, our clients can choose their desired alert and only pay for the stocks symbols that they want to see. Scan the stock market and get your alert!

This service is recommended for investors that possess high technical skills who would like to choose their desired alert and only pay for the stocks symbols that they want to see.

Read moreExperience Free Yard Charts, check some patterns!

Try Now