Basic

Get ready to use Yard Charts

The importance of fundamentals market forces.

To optimize the Yard experience, the trader/investor is strongly advised to begin by assessing a market sector’s general conditions based on macroeconomic trends and statistics. This means that they must assess the fundamental reasons why they believe a general market sector is bullish or bearish. By doing this, the trader/investor will develop an opinion about market tendencies based on fundamental reasoning. Once the trader/investor is confident in their take on the associated general market risks, they can use Yard Charts to scan the same markets for those stocks (micro-realities) that present themselves in the form of bullish or bearish technical pattern configurations. It is important to note that even while using Yard Charts, it will be harder, riskier, and on average less fruitful to follow bear patterns during a general bull market and vice versa. It has not been uncommon for Yard Charts Software to signal tendencies well before they become the subject of fundamental discussions or evident in fundamental statistics. This is the beauty of technical analysis, but it still remains a risky endeavor, and market participants should be aware of this beforehand (Read disclaimer in Terms and Conditions).

Time Intervals.

One of Yard Chart’s main features is the INTERVAL. As a user, you will always be prompted to choose an interval, but what does this mean? Intervals refers to the time frame of observation, data recording, and allocation, for the purpose of constructing charts. The YARD bar charts are constructed with a common format: Open, High, Low, Close, and Volume. Each of these entities are associated with a time interval. Yard supplies charts based on daily intervals.

Daily Interval

Intervals formed by the Open, Low, Close, and Volume are traded on a given day for any given stock or commodity. Daily bars will therefore be constructed and added in succession every passing day.

Liquidity.

It is important to understand the concept of liquidity and the market risk associated with it. At Yard, we are primarily concerned with how easily and at what cost a stock can be bought or sold. Thus, we examine how wide the spread between bid and ask price is and what number of shares are available for trading at those prices. Stocks with great liquidity allow the trader to deal in relatively bigger sizes at less risk, as a market will usually be guaranteed to be there to absorb the orders. Stocks with little liquidity are riskier as even small orders will be likely to move away prices, and should the investor be compelled to unwind a position, there will not always be a market there for absorb his trade at the prevailing prices. Furthermore, stop orders will likely be affected by greater extreme slippage. In order to provide a measure of liquidity for each stock signaled as alarm, Yard Charts implements a formula that examines the dollar amount needed to move a given percentage of the same stock. The greater this dollar amount, the higher the liquidity of the given stock. We thus obtain a value or a liquidity ratio that ranges in the hundreds of thousands for most liquid stocks (such as those in the Dow30) to the low hundreds and even into double and single digit values for the most illiquid penny stocks that crowd the exchange.

| Liquidity Ratio | Liquidity Category | Liquidity Classification |

|---|---|---|

| > 50,000 | A + | Extremely liquid stock |

| > 20,000 < 50,000 | A | Very liquid stock |

| > 10,000 < 20,000 | B | Liquid stock |

| > 5,000 < 10,000 | C | Fairly liquid stock |

| > 1,000 < 5,000 | D | Sufficient to moderately liquid stock |

| > 500 < 1,000 | E | Little to sufficiently liquid stock |

| > 0 < 500 | I | Not liquid to little liquid stock |

Trader Behavior.

How to Select a Security.

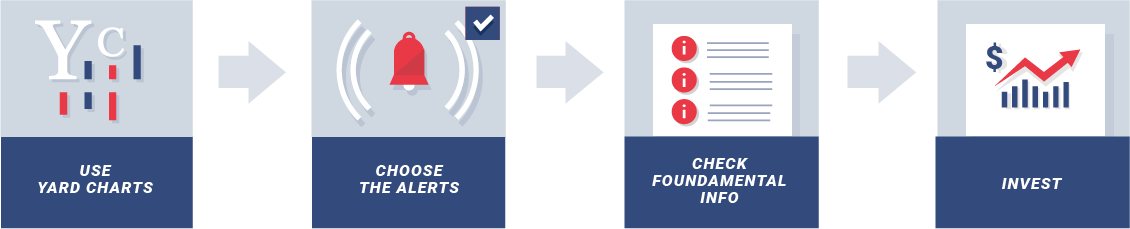

Now that we’ve discussed the basics, you can proceed as a trader. The trader should start by looking at the alerts generated by the system and select the ones he/she likes the most. Your selection process is very important and is also very personal. At Yard Chart we check for the best technical alerts (The ones that resembles the most our key model patterns), then we check the sector/industry of the stock, and lastly, depending on the size of our position, we might go check the fundamentals of the company. As said previously, this is very personal and it can vary a lot from one trader to the other. You don't need fundamental analysis knowledge to do your trades but it might help you build your confidence about it. To us, the most important part is the technical knowledge. We believe the charts talk before the news, so we like to position ourselves at the right moment.